Description

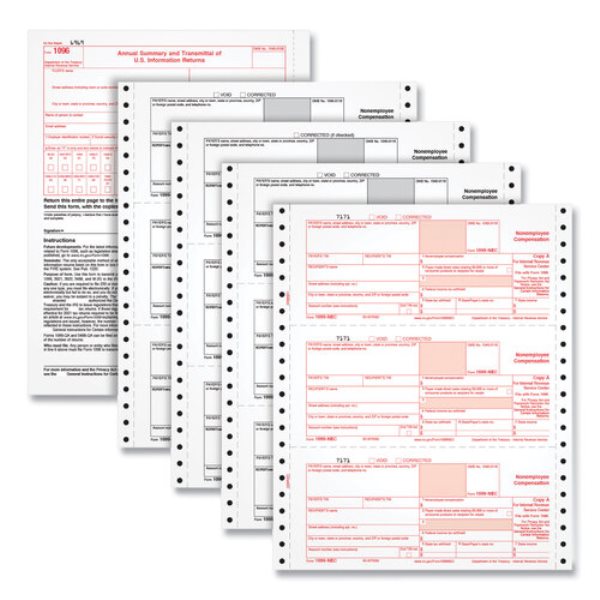

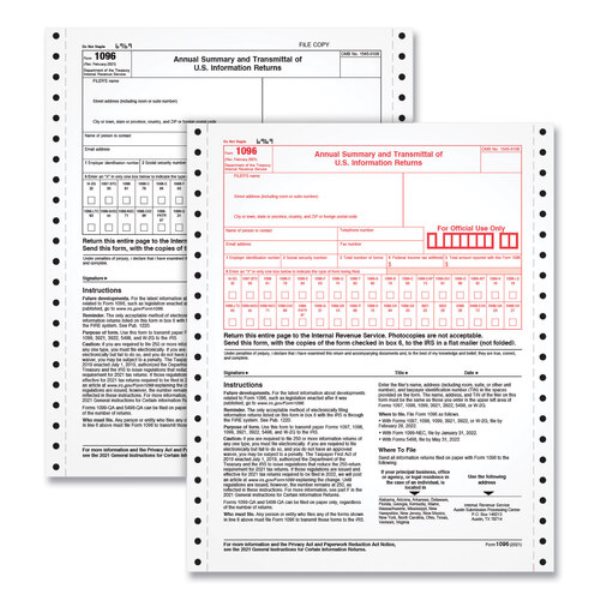

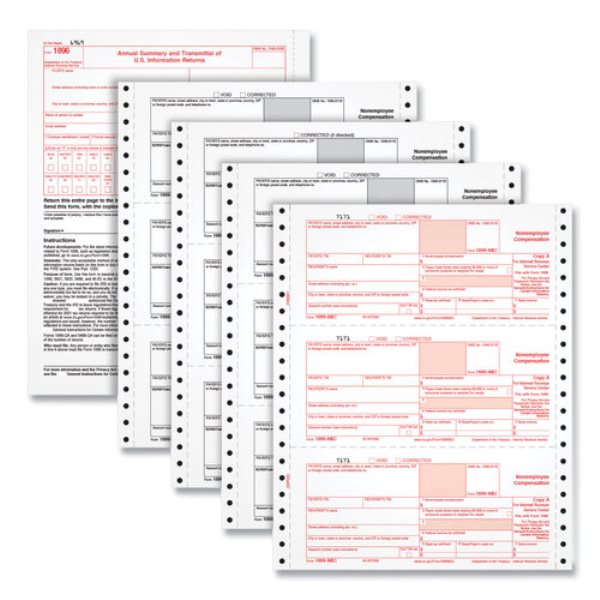

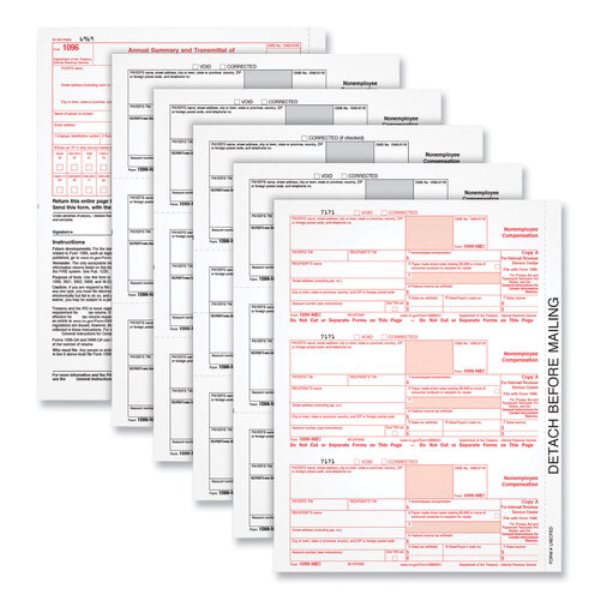

TOPS™ 1099-NEC Tax Forms report nonemployee compensation paid to your independent contractors. This year, the IRS has reduced the size of the NEC to fit 3 forms per sheet. Our acid-free paper and heat-resistant inks help you produce smudge-free, archival-safe tax forms. Copy A and 1096 sheets have the scannable red ink required by the IRS for paper filing. Includes three 1096 forms per pack. All TOPS™ tax forms meet IRS specifications. Forms are QuickBooks and accounting software compatible. <ul><li>This TOPS™ forms pack provides 4-part 1099-NEC continuous feed forms for dot-matrix printers and 1096 summary forms.</li><li>Use Form 1099-NEC to record nonemployee compensation to the IRS and recipients.</li><li>Acid-free paper and heat-resistant inks help you produce legible, smudge-free, archival-safe records.</li><li>Print 3-up on micro perforated sheets; includes IRS scannable red ink pages with copies A, State, B and C.</li><li>Meets IRS specifications; accounting software and QuickBooks compatible.</li><li>The 1099-NEC is due to the IRS and your recipients by January 31, 2022.</li></ul>

Be the first to review “TOPS™ 4-Part 1099-NEC Continuous Tax Forms” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.